STEPS TOWARDS VALIDATION AND VERIFICATION PROCESS OF VOLUNTARY EMISSIONS MECHANISMS

VALIDATION AND VERIFICATION PROCESS

There are various emissions trading mechanisms through which voluntary offsets are issued to projects that reduce or remove greenhouse gas (GHG) emissions. The projects can be certified by a plethora of carbon mechanisms out of which the most prominent ones are listed hereunder:

• Clean Development Mechanism under UN Framework Convention on Climate Change (UNFCCC);

• Gold Standard;

• Verified Carbon Standard by Verra;

• Global Carbon Council

The certification consists of Validation and Verification. Validation and Verification are required by the carbon mechanism in order to guarantee that the mandatory requirements are met and the methodologies are properly adhered to. Carbon Mechanisms have their respective Validation and Verification Bodies (VVB) that offer accreditation to a project under consideration. For example, Clean Development Mechanism (CDM) audits are conducted by a designated operational entity (DOE) which is an independent auditor accredited by the CDM Executive Board (CDM EB) to validate project proposals or verify whether implemented projects have achieved planned greenhouse gas emission reductions.

The binary process of Validation and Verification is explained hereunder:

Validation is an assessment of the Project Design of a voluntary emission reduction project before it becomes operative. It ensures that the project fulfils the mechanism’s requirements and generates tradable credits. The VVBs thereafter apply to have the project registered with the concerned mechanism or the other voluntary carbon entities.

Typically a Validation contract is signed between the Mechanism and the Project Participant(s). The Mechanism starts the formal validation process when related application documents (including the Project Design Document) is received. A comprehensive list of such application documents is provided in Annexure A. The validation process includes: making PDD publicly available; desk review; on-site visit and assessment (if applicable); and completion of draft validation report; internal technical review; completion of final validation report and submission of request for registration to the Governing Board of the Mechanism in question. The Governing Board makes the report publicly available and registers the project as an official entity if no other issues are identified.

1. One Time Validation of Project Design (before or during project implementation); and

2. Periodic Verifications of the volume of emission reductions or removals (during and/or after project implementation).

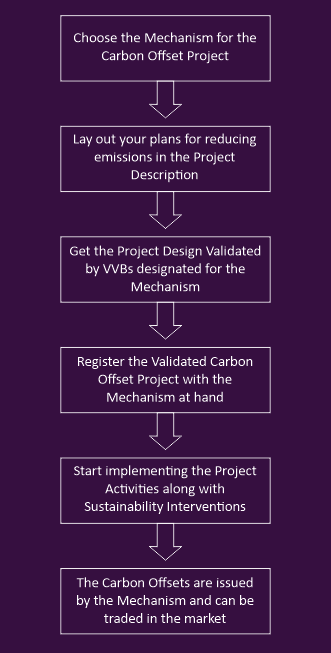

FLOW CHART OF THE OVERARCHING PROCEDURE

WHERE CAN CARBON OFFSETS BE TRADED?

Carbon Offsets can be traded on both private and public markets. Current rules of trading allow the international transfer of offsets as well.

The prices of offsets are primarily driven by the levels of supply and demand in the markets. Due to the differences in the supply and demand in different countries, the prices of the offsets fluctuate.

Although carbon offsets are beneficial for the society, it is not easy for an average investor to start using them as investment vehicles. The Emission Reduction Units (ERUs) are the only product that can be used as investments in the offsets. However, ERUs are sold by special carbon funds established by large financial institutions. The carbon funds provide small investors with the opportunity to enter the market.

There are special exchanges that specialize in the trading of the offsets, including the European Climate Exchange, the NASDAQ OMX Commodities Europe exchange, and the European Energy Exchange. Various Stock Exchanges have opened up special bourses for trading of the offsets.

There are special exchanges that specialize in the trading of the Carbon Offsets, including the European Climate Exchange, the NASDAQ OMX Commodities Europe Exchange, and the European Energy Exchange.

THE INDIAN CONTEXT

India, the largest exporter of carbon credits, proposes to have its own uniform carbon market in one year as a large finance avenue for energy transition projects and emission reduction. An analysis by Deloitte Economics Institute showed that India could gain $11 trillion over 50 years by limiting rising global temperatures and realising its potential to 'export decarbonisation' to the world. Government of India is considering a change in legislation for implementing the carbon trading scheme that will subsume all such present tradeable certificates.

The present schemes are very limited as buyers are very limited. Once India opens a formal carbon trading market, and it has the conversion factor of every such certificate into how much CO2 has been avoided, the market will be very large. The market-determined price would then reflect the true picture.

The Lok Sabha (Lower House of Parliament of India) has already passed the Energy Conservation (Amendment) Bill, 2022, in August 2022 clearing the way for establishing carbon credit markets.

Government of India proposes to begin with a voluntary market considering net-zero announcements made by large corporates. A gradual shift to 'cap and trade', where industries are given emission targets like in EU emission trading system markets is proposed.

Under the present Perform, Trade and Achieve scheme, Energy Saving Certificates (ESCerts) are traded. Similarly, renewable energy certificates (RECs) are traded to let entities meet renewable purchase obligations.